Protecting Your Credit Report

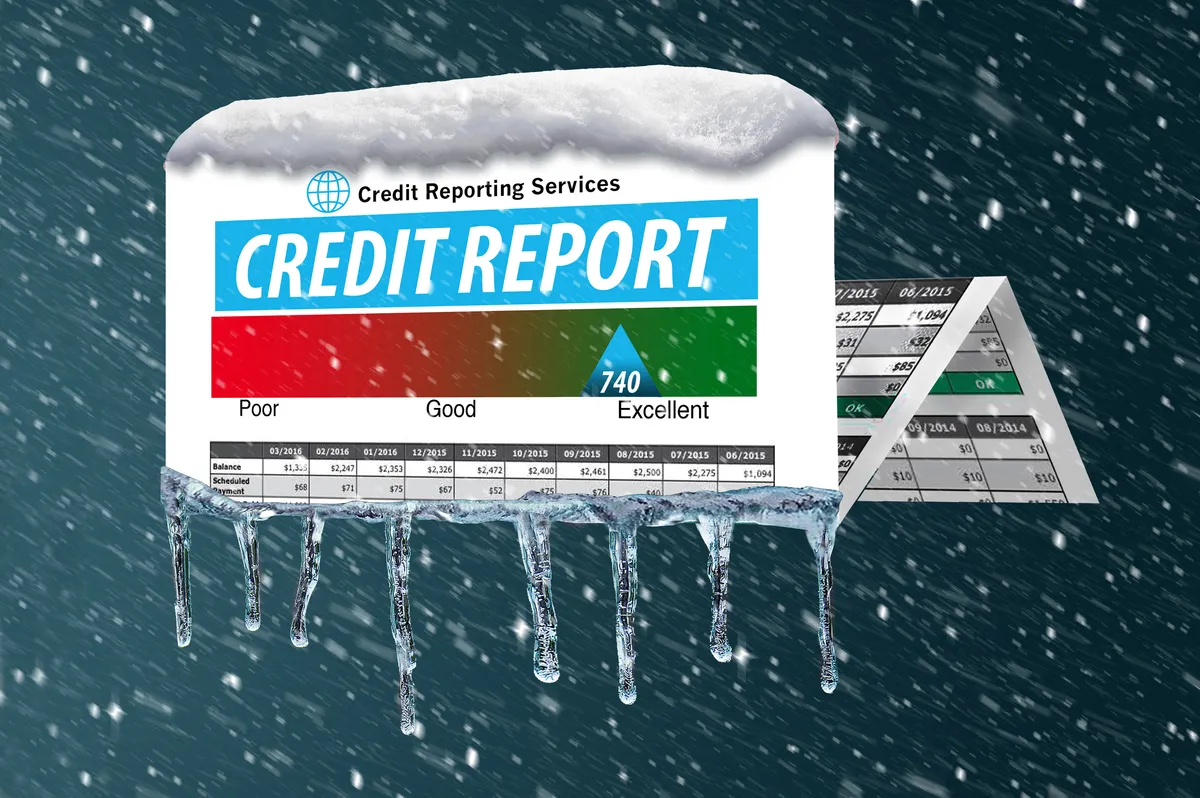

Should You Freeze Your Credit Report

Freezing your credit report can be valuable, particularly in today's digital age, where identity theft and cyber fraud are rising. It stops fraudsters from illegally applying for credit using your identity and restricts you from applying for credit without first unfreezing your reports.

Why Should You Freeze Your Credit Report?

Preventing Unauthorized Access to Your Financial Information: Freezing your credit report restricts access to your credit history, making it significantly harder for unauthorized individuals to open new accounts or lines of credit in your name.

Protection Against Identity Theft: Credit freezes are a robust deterrent against identity theft and financial fraud. They provide peace of mind in an era of widespread data breaches and cybercrime.

Control Over Access to Your Credit Report: With a credit freeze, you have greater control over who can access your credit report, helping you avoid unwanted solicitations and inquiries.

Free of Charge: Placing a credit freeze is free (as Federal law mandates) and will not affect your credit score. It provides a cost-effective and powerful security measure. Visit each bureau’s site: TransUnion, Experian, and Equifax. They will all try to upsell you on products and services, but you don’t need to sign up for them to freeze your credit.

When Should You Freeze Your Credit Report

After a Data Breach: If you’ve been involved in a data breach or suspect that your personal information may have been compromised, it's wise to freeze your credit report. This step ensures that unauthorized individuals cannot use your data to open new accounts or lines of credit in your name.

Protecting Your Children's Credit: In an era where children's identities are increasingly targeted, freezing your children's credit reports until they are old enough to use them responsibly can prevent criminals from exploiting their clean credit history.

Financial Hardships: During periods of financial strain, such as economic downturns or job loss, freezing your credit report can be a proactive way to protect yourself from potential financial fraud. It ensures that your credit remains secure even during difficult times.

Freezing your credit report can be a vital safeguard in an era dominated by digital transactions and online financial activities. It offers a simple yet effective way to secure your financial well-being and personal information.