Credit Management

Understanding Interest Rates and How to Pay Less Interest

Understanding the amount of interest you will pay when borrowing money or using credit is critical to keeping your costs low.

Interest is an additional fee for borrowing money or using credit. It is rent you pay for using someone else's money. Most lenders will charge interest on a loan or credit card balance to make a profit from the funds they have lent out. The interest you pay is based on your loan amount, interest rate, and the length of your loan term. Generally, interest rates are set based on your credit score, income, and debt-to-income ratio.

The good news is that there are ways to pay less interest. By lowering your interest rates, paying off balances more quickly, and splitting up monthly payments, you can save yourself money and still get access to the credit you need.

Interest is typically calculated based on the amount borrowed and the time it takes to repay the loan. For example, if you borrow $500 and must pay it back in 6 months, you might have an interest rate of 10%. You must pay an additional $50 in interest to repay your loan.

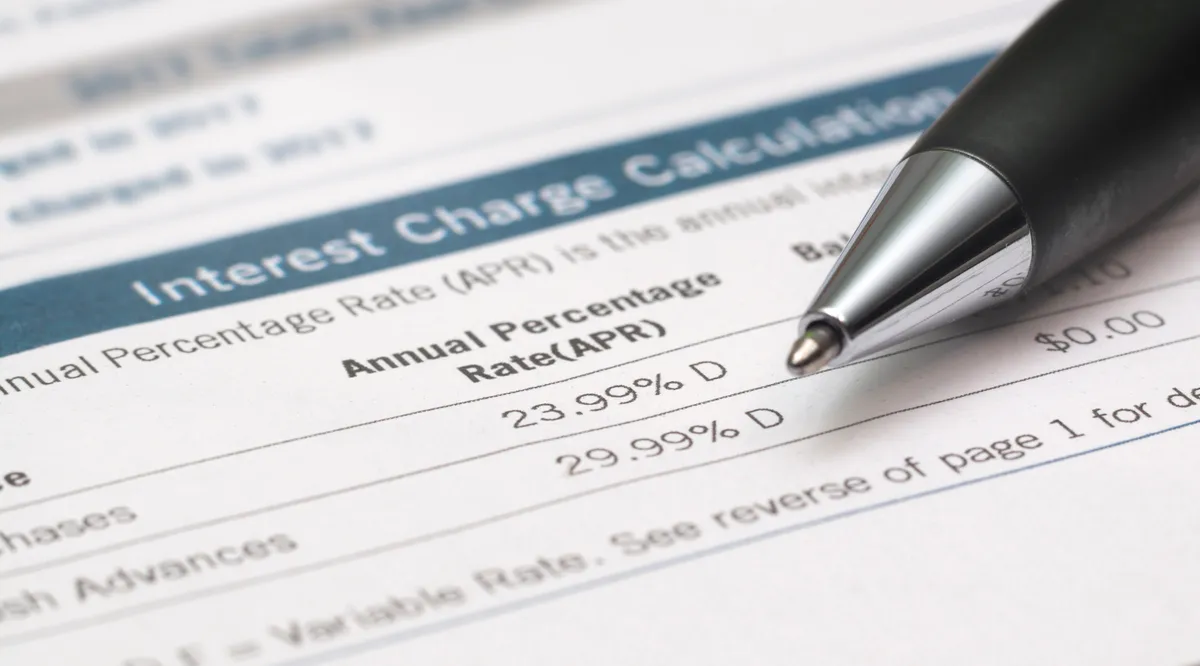

It’s also critical to understand the APR, which stands for Annual Percentage Rate-- the measure of the cost of borrowing money over one year. You can also use the APR to understand how your interest is compounded daily. You can start figuring out your daily periodic interest rate by dividing your annual rate (the APR) by 365 -- the number of days in the year. If your annual percentage rate is 20%, your daily rate will be 20% divided by 365, or 0.055%.

Calculate your daily periodic rate by multiplying it by the balance on your credit card to find the amount of interest you pay daily.

In addition to understanding how interest is calculated, you can do a few things to pay less interest and lower your overall cost for credit. For example, you can make larger payments or repay your loan earlier than expected. In addition, you can negotiate with lenders for lower interest rates or more flexible repayment terms.

When it comes to reducing the amount of interest you pay each month, you can use a few simple strategies. The first is to lower your interest rates. You can do this by shopping for the best rates and ensuring you have good credit. Another way to pay less interest is to split monthly payments into smaller chunks.

You can also call your creditor and ask for a lower interest rate. Be sure to tout the length of your relationship with them and that competitors offer lower rates. If you are planning a big purchase, let them know that a lower interest rate would entice you to use their card.

Splitting monthly payments is another way to pay less interest and lower your interest rates. This strategy is simple and can be used for any loan or credit card debt. By splitting up your payments into smaller chunks each month, you will pay less interest over the life of the loan.

When you split monthly payments, you reduce the time the interest rate is applied to the outstanding balance. This means the less time your interest rate is applied, the less interest you will pay.

In addition, splitting your payments can help you avoid penalties for missing a payment if one of your split monthly payments is late.

Splitting up your monthly payments can help you save money and pay less for credit. Not only can it reduce the amount of interest you pay overall, but it can also help you avoid late fees and penalties. So, if you are looking for ways to pay less interest, consider splitting up your monthly payments to see if it helps you save money.